Common Scams

I’ve been a victim of scams multiple times. It’s disheartening when your kindness is taken advantage of, and it often feels like there’s little you can do to get your money back. I’ve been scammed by panhandlers asking for money for fuel, and once by someone who sold me a working used iPhone only to report it lost for insurance money later. I can relate to the feeling of anger and hurt if you have been a victim yourself.

I’ve learned that knowledge is our greatest protection. Instead of letting fear take over—something scammers prey on—let’s focus on building a stress-free defense.

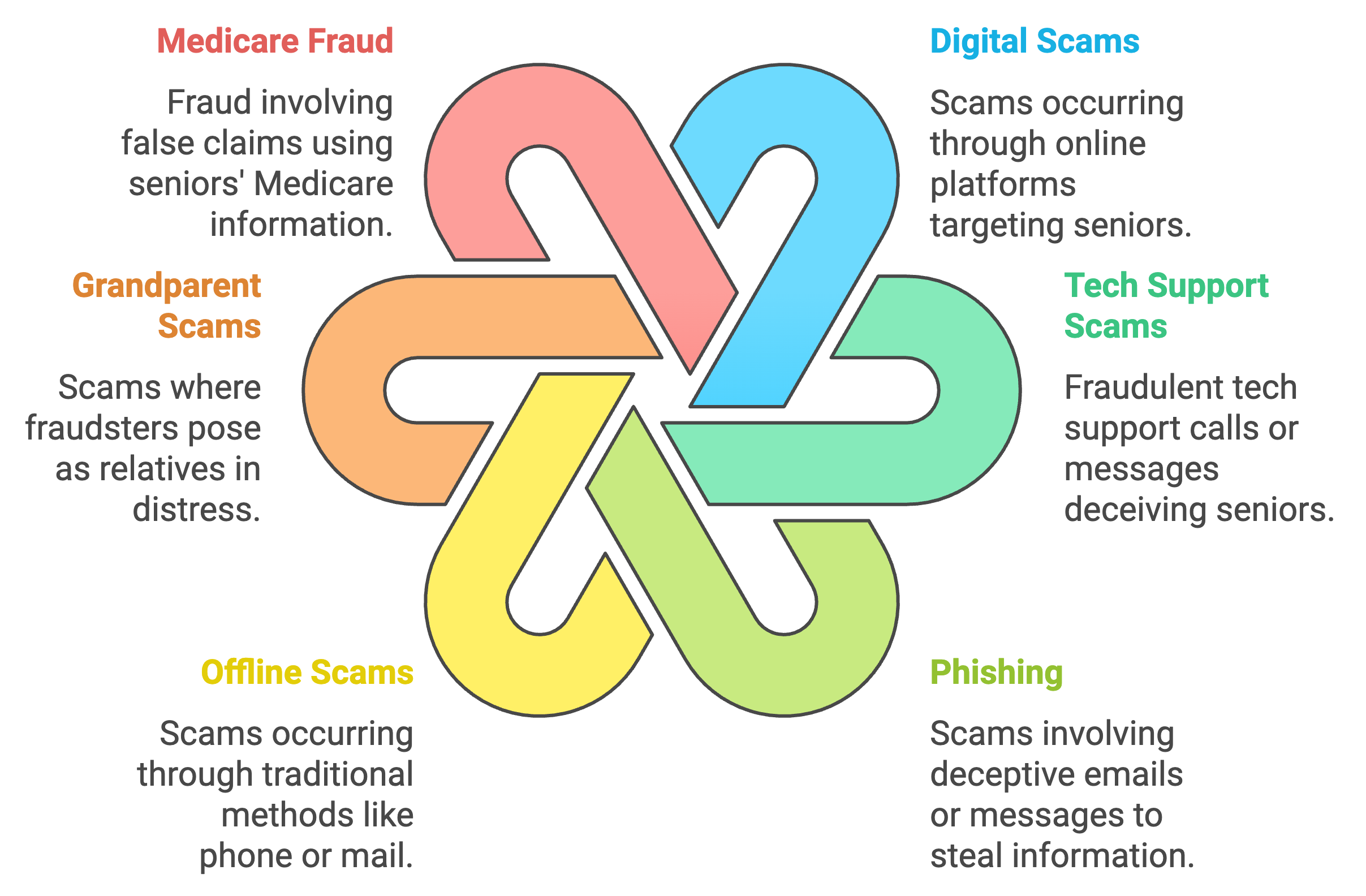

Here are a few common scams in US targeting senior citizens. Once you know them, you would be able to identify them with ease when you happen to be the target.

1. Tech Support Scams

- How It Works: Seniors receive a call or pop-up on their computer claiming their device has a virus or security issue. The scammer convinces them to pay for unnecessary repairs or software by granting remote access to their computer.

- Result: The scammer may steal personal information or install malware, leading to further theft or extortion.

- Remedy:

- Hang Up Immediately: Never give remote access to your computer or pay for tech support services from unsolicited callers. If unsure, you should contact your computer’s manufacturer or a trusted local technician.

- Scan for Malware: If they are granted access, run a malware scan on the computer using reputable antivirus software. Take help from reputable tech support companies like Costco, BestBuy, Apple, etc.

2. Medicare and Health Insurance Scams

- How It Works: Scammers call seniors claiming to be Medicare representatives and ask for personal information, such as Social Security numbers, under the pretense of needing it for a new Medicare card or to update their records. The scammer could impersonate as a utility company, bank representative, etc. and trying to help correct something. They might have some information about them and use that to convince them to give more.

- Result: The scammer may use this information to commit identity theft or submit fraudulent claims to Medicare.

- Remedy: Do Not Share Personal Information. Medicare will never call and ask for personal information over the phone. Encourage them to hang up and call Medicare/Utility company directly by using contact number from official website. Do not call back on the number the scammers ask you to.

3. Grandparent Scam

- How It Works: A scammer pretends to be a grandchild in distress, claiming they need money urgently for an emergency, such as bail, medical expenses, or travel. They often ask the senior not to tell anyone and request the money via wire transfer or gift cards. They might be texting or calling from a different phone saying that their wallet and phone are stolen or lost. Remember, things are rarely urgent. Think, get others involved.

- Result: The senior, believing they are helping a loved one, sends money to the scammer.

- Remedy: Verify the Caller. Advise seniors to stay calm and verify the identity of the caller by asking personal questions only their real grandchild would know or by calling a trusted family member. Decide on a secret word that’s not written anywhere and only your loved ones and trustworthy would know. Never send money or provide financial information over the phone without confirming the situation, especially as gift cards or wire transfer.

4. Investment and Financial Fraud

- How It Works: Scammers offer seniors investment opportunities that promise high returns with little risk. These could range from fake stocks, bonds, or real estate deals, time shares to more elaborate Ponzi schemes.

- Result: Seniors may invest their savings in these fraudulent schemes, losing their money with little to no recourse.

- Remedy: Consult a Financial Advisor. Before making any investments, seniors should consult with a trusted financial advisor. Be skeptical of any offers that promise high returns with little risk.

5. Fake Charity Scams

- How It Works: After a natural disaster or during the holiday season, scammers pose as representatives of charities and solicit donations over the phone or through email. Instead of asking to donate on the website, they ask to wire transfer or send check/cash to different account.

- Result: The money goes to the scammer instead of a legitimate charity, and the senior’s personal information might be stolen as well.

- Remedy: Research Before Donating. Research charities through resources like GuideStar, CharityNavigator before donating. Donate directly through the charity’s official website. Personally, I prefer donating through organized non-profit organizations than panhandlers as they have a much more sustainable way to provide benefits to the needy.

6. Home Repair Scams

- How It Works: Scammers show up at a senior’s door offering discounted or urgent home repairs. They might ask for payment upfront and either do shoddy work or disappear without doing any work.

- Result: The senior loses the money they paid, and the needed repairs are not completed.

- Remedy: Get Multiple Quotes. Seek multiple quotes from reputable contractors, verify licenses, and avoid upfront payments. Use local and trusted companies with high ratings. Use Checkbook to research such vendors. As a general rule, stay away from all marketeers and solicitors. If you need something, go to a vendor or business yourself.

7. Romance Scams

- How It Works: Scammers pose as potential romantic partners on dating websites or social media, gradually building a relationship with the senior. They then invent a financial crisis and ask for money.

- Result: The senior, believing they are helping someone they care about, sends money to the scammer, who often disappears afterward.

- Remedy: Be Cautious with Online Relationships. Be wary of relationships that develop quickly online and involve requests for money. Never send money or share personal information with someone you haven’t met in person.

8. Sweepstakes and Lottery Scams

- How It Works: Seniors receive a call, email, or letter claiming they’ve won a large sum of money or a prize. The scammer instructs them to pay taxes or fees upfront to claim the prize.

- Result: The senior sends money but never receives any prize, as the lottery or sweepstakes was fake.

- Remedy: Understand the Rules. Legitimate lotteries and sweepstakes do not require payment to claim a prize. If asked to pay upfront, it’s a scam. Do not pay.

Rajat Aggarwal

I'm based in Seattle and have spent over a decade in the software industry. Recently, I've discovered my true passion: teaching and maximizing the impact of the resources I have to create meaningful outcomes. When I’m not sharing knowledge, you’ll likely find me diving into random science books from the library, letting my curiosity whisk me away into fascinating new worlds. I’d love to connect—feel free to reach out on Facebook or LinkedIn! Let’s inspire and grow together.